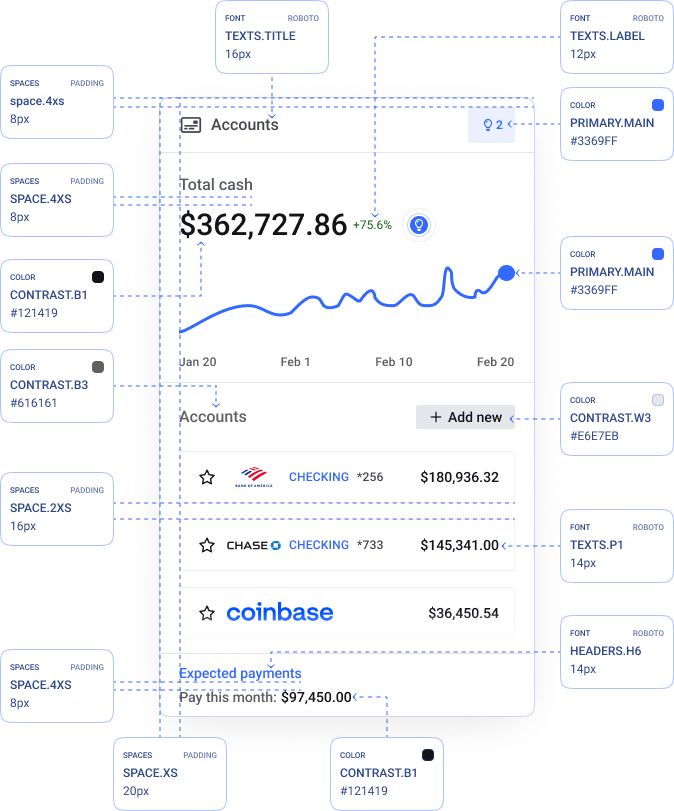

There is no item we can't customize

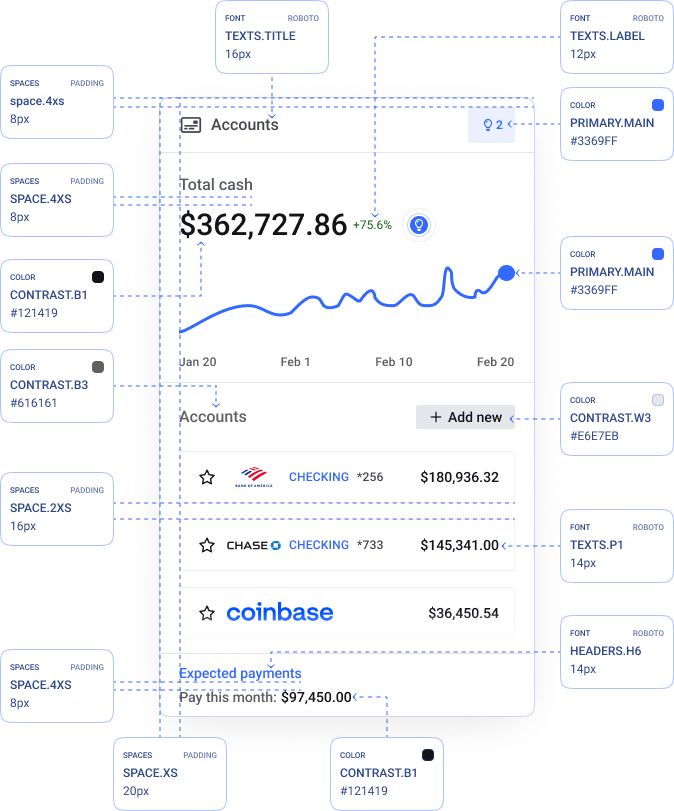

One of the advantages of our components is maximum customization for your financial institution. Adjust color, font, and just about anything else you can think to ensure our components match your brand perfectly.

Make your financial institution the go-to source for business clients to view their business health. upSWOT brings together and simplifies data from dozens of business applications; creating a clear picture of business performance and personalized suggestions for improvement.

Bring the power of actionable insights created from dozens of applications inside of your digital banking experience - with just 3 lines of code. Let business customers access their complete financial life in one powerful app: yours!

Select from the list below to see some of the features that you can deliver today

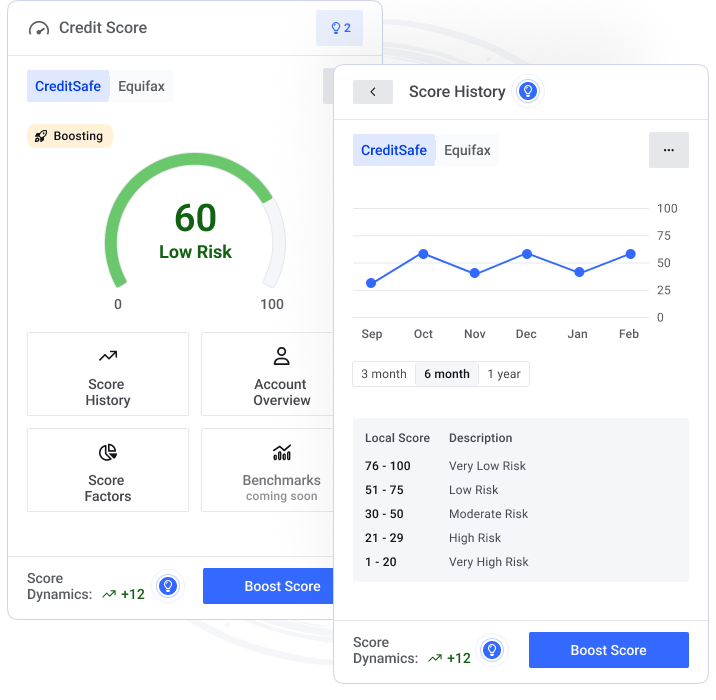

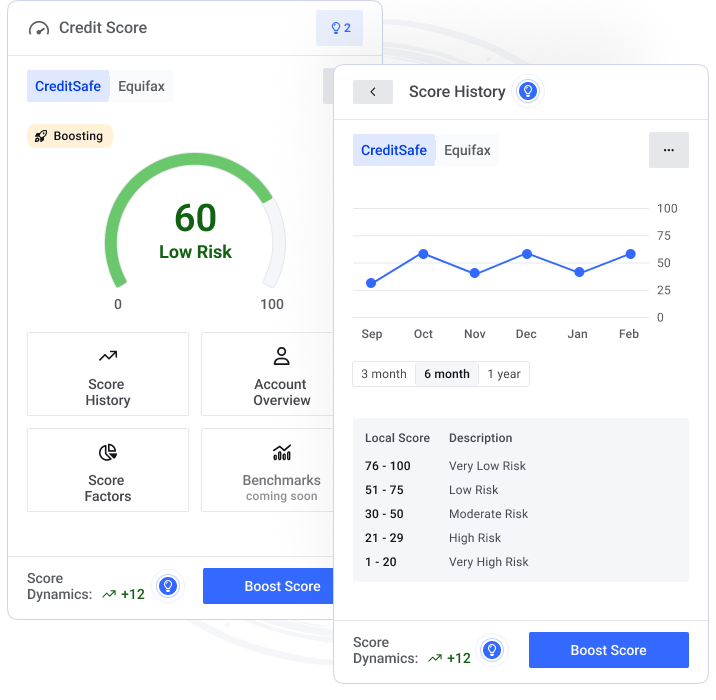

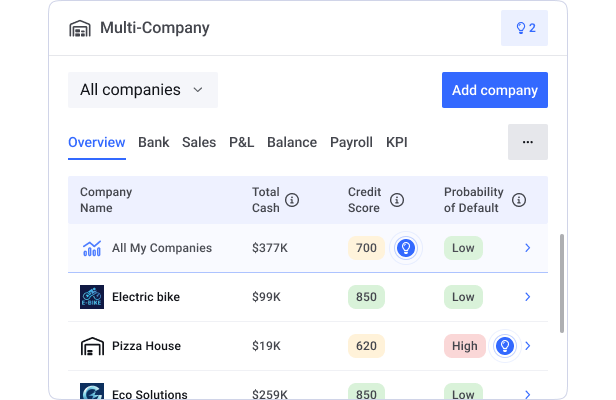

Revolutionizing how business credit scores are seen, our tool enables businesses to get access to view and boost business credit scores.

Establishing the business credit score results in an improved lending process that expands access to credit, reduces borrowing rates, and better loan conditions.

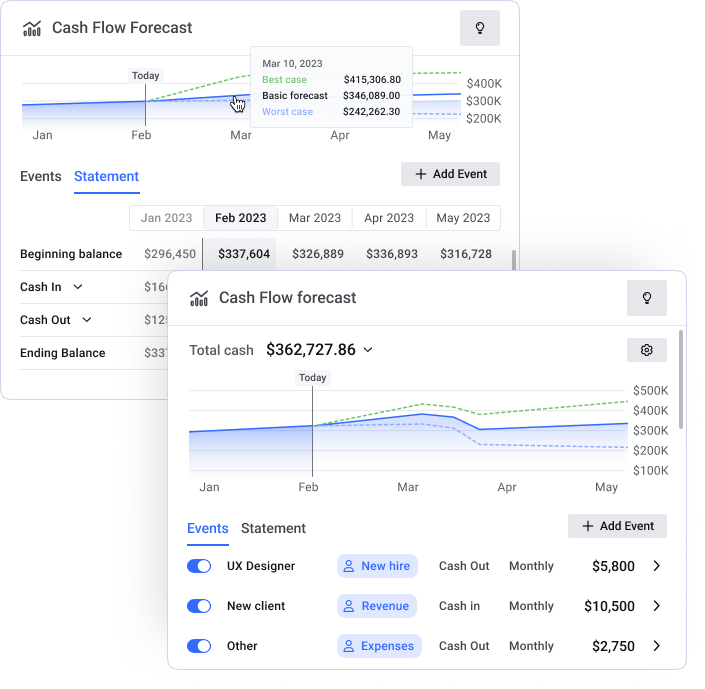

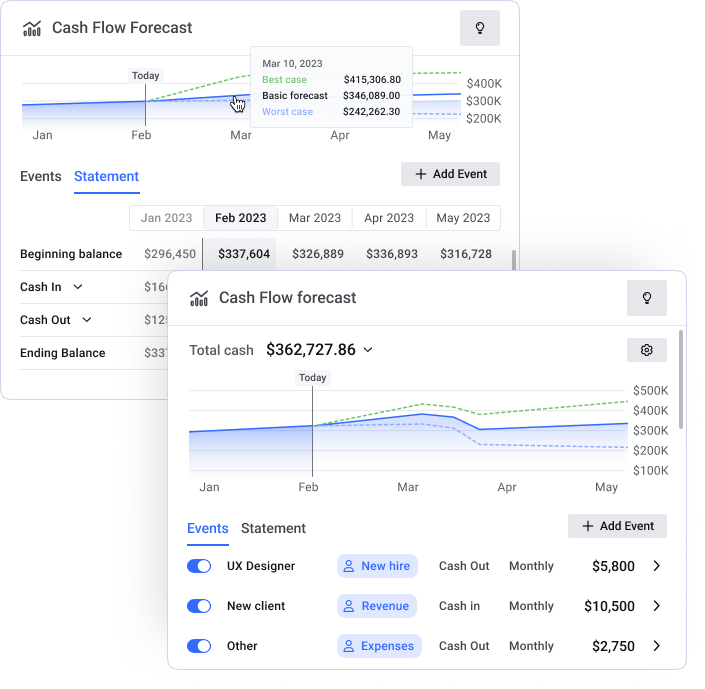

upSWOT's cash flow forecast presents a graphical projection of cash flow based on analysis from all connected data sources. The tool also presents confidence intervals to illustrate best- and worst-case scenarios.

The tool also allows for scenario modeling. This feature allows the business owner to model the impact of changes in revenue or expenses over time.

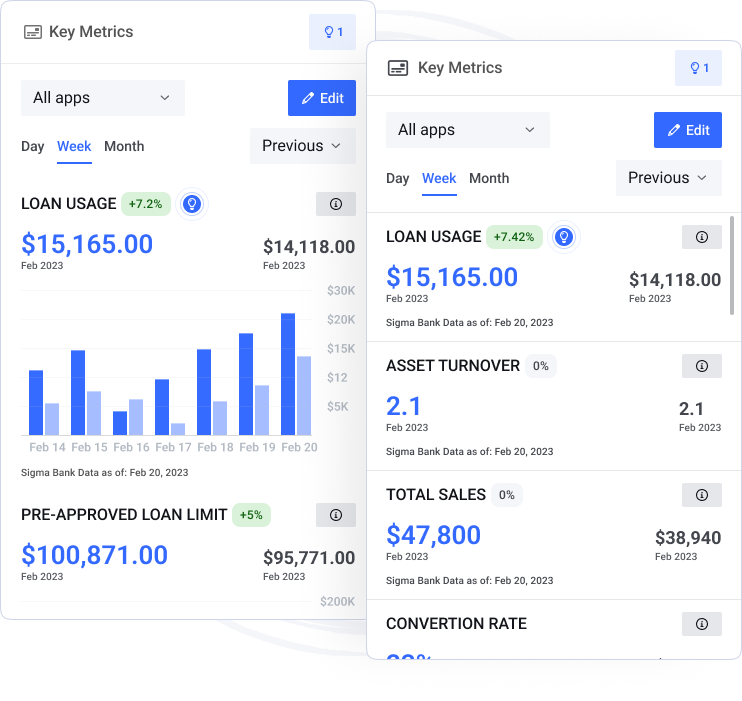

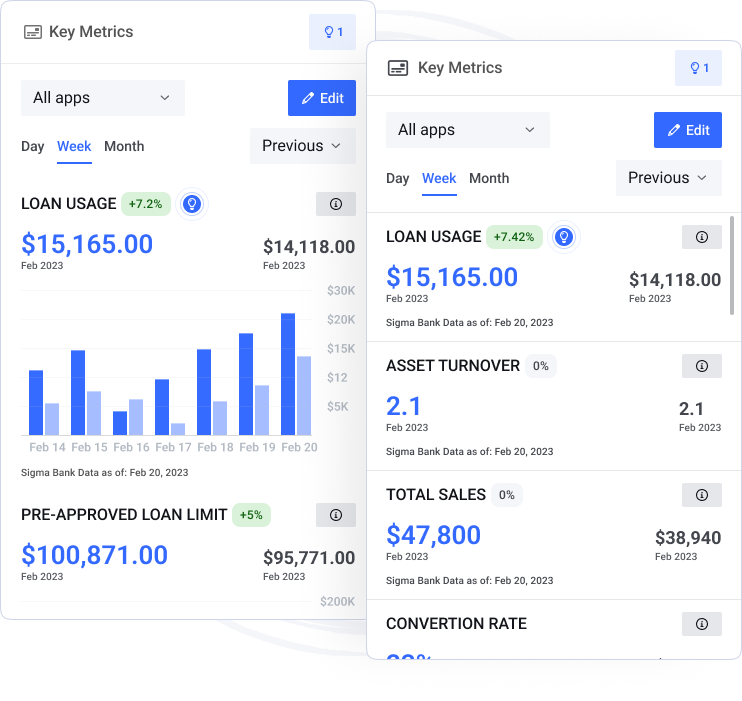

Key Performance Indicators (KPIs) are a critical indicator of business performance. upSWOT's KPIs are derived using a combination of FI and data received from connected applications, such as Amazon, Xero, QuickBooks, Square, etc.

The data is constantly updated through our persistent process and allows business owners to have health indicators available at a glance.

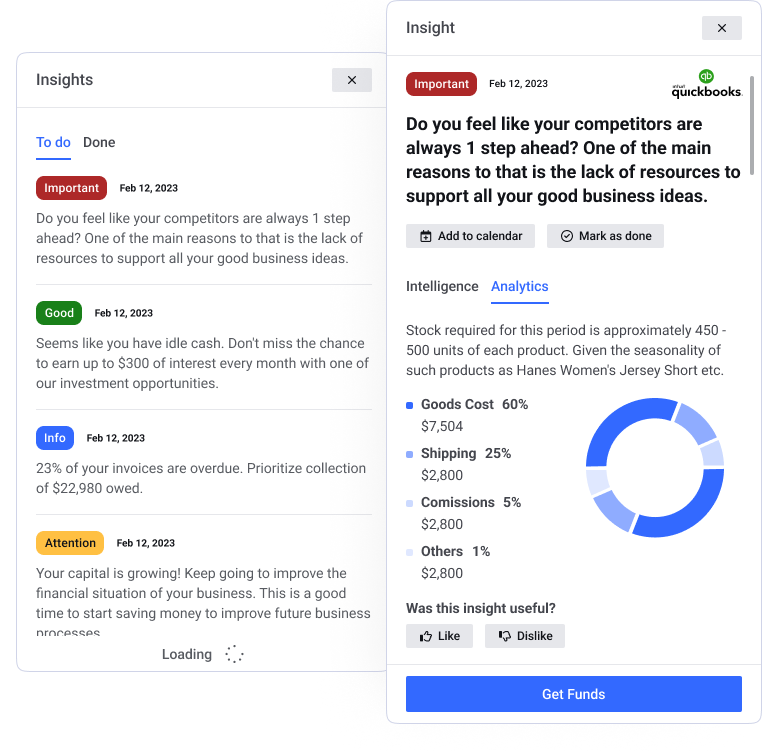

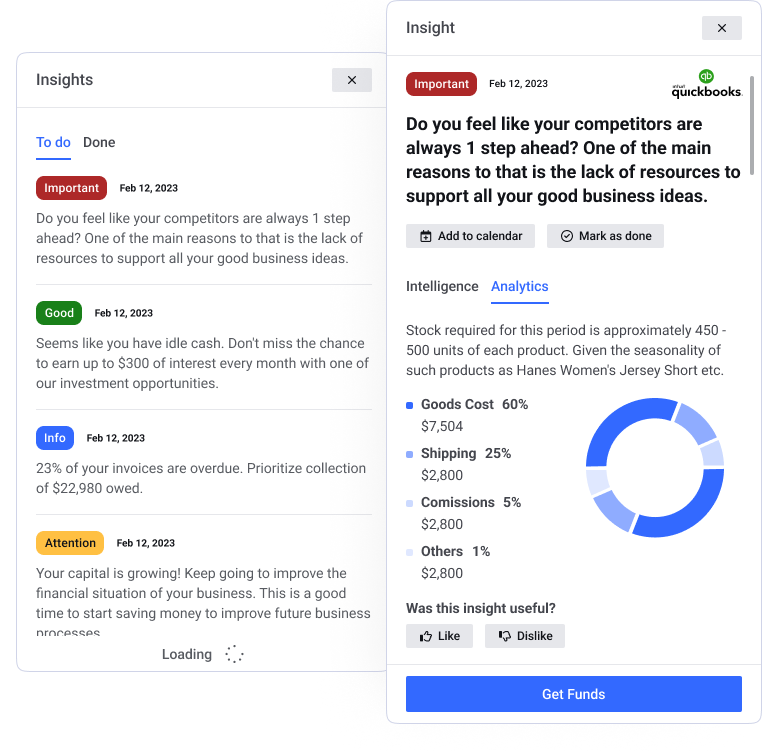

Our insights generator cross-analyzes multiple applications’ data streams to understand current issues facing the business and how to resolve them. The data-driven insights suggest specific actions the business can take to improve operations and profitability.

Insights are delivered in real-time and with context and supporting detail to ensure they are understood and trustworthy.

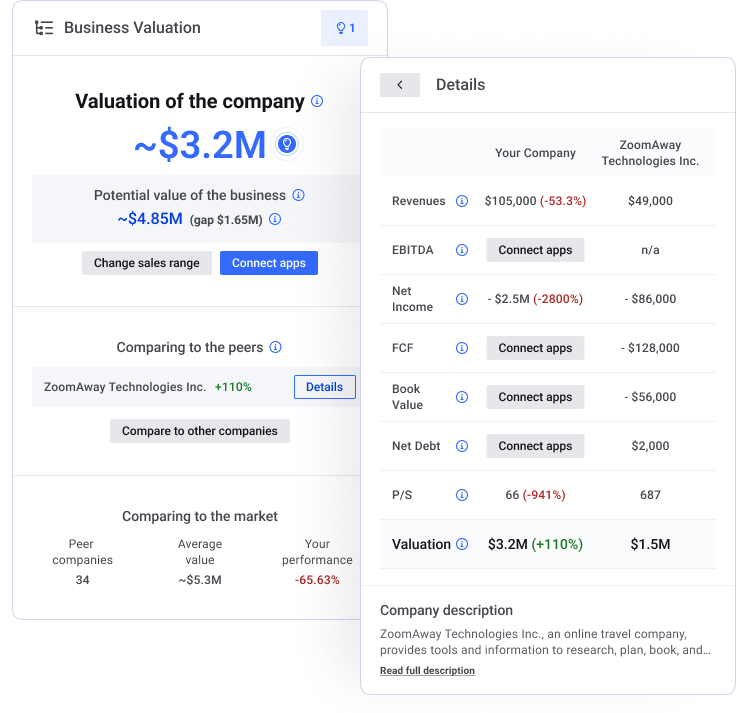

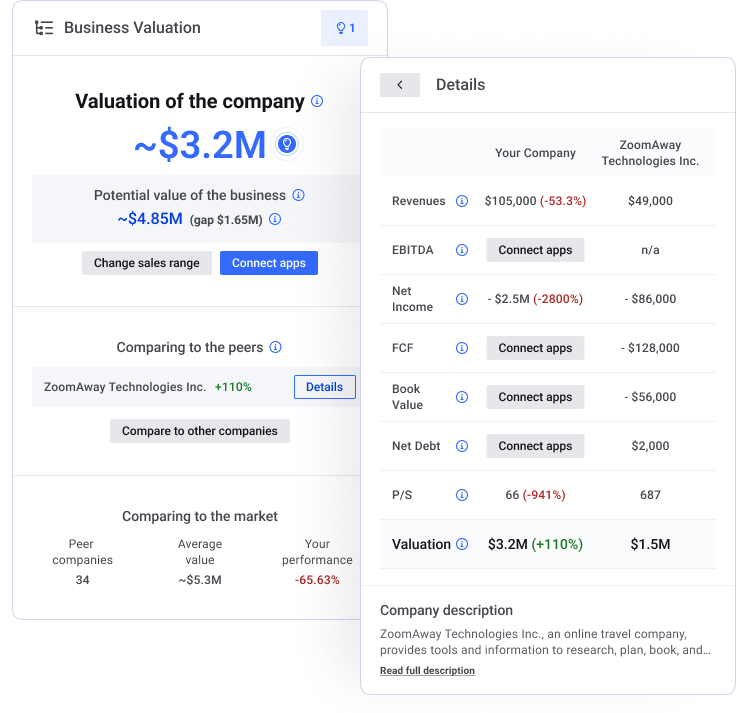

Business valuation and market value estimates are important tools for setting business strategy. The valuation maps significant insights, tracks shortcomings, solves identifiable issues, and suggests steps to avoid potential problems.

The results from the model selected by our AI can be compared with those of similar public companies, helping businesses look at their performance from a more wholistic, competitive perspective.

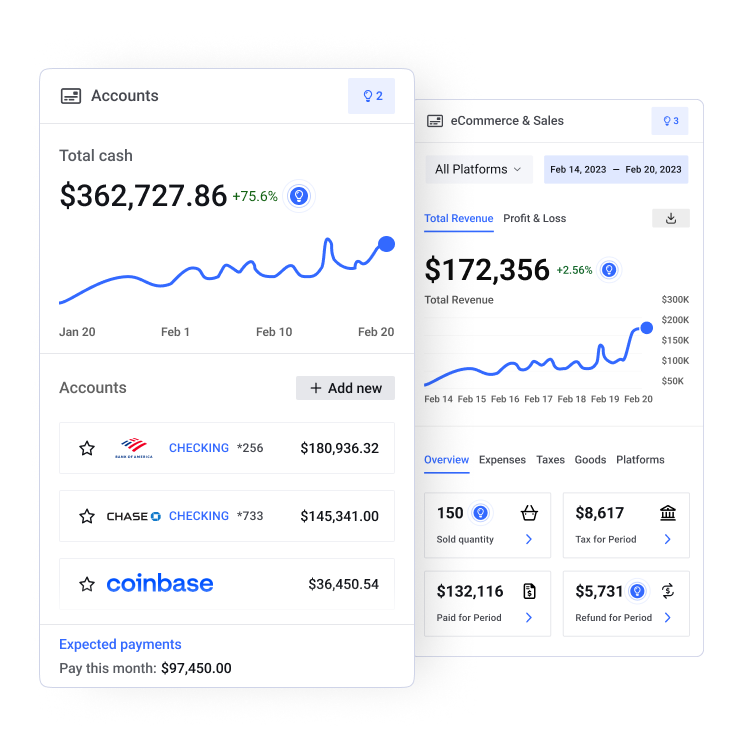

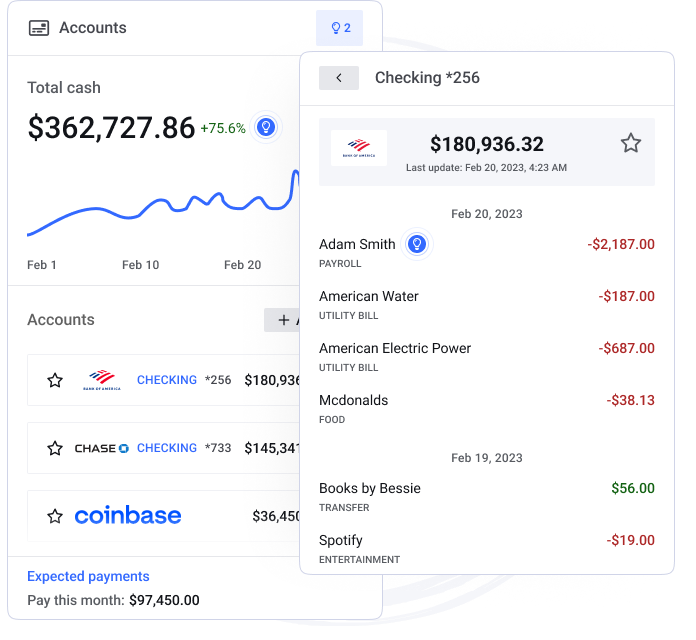

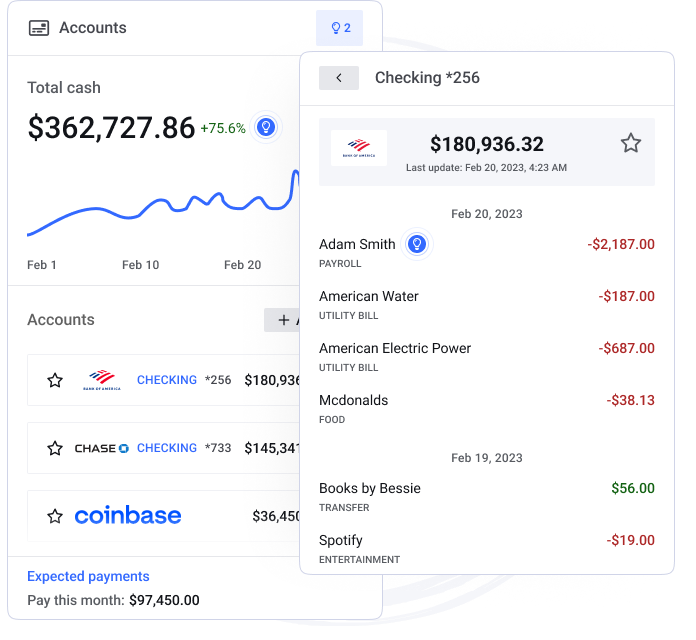

The Accounts component shows businesses their current cash position across all of their accounts. This can include those held at other financial institutions, eWallets, and cryptocurrencies.

Where available, open-banking API are leveraged to provide transaction-level detail from aggregated accounts, allowing further insight and analysis of spending patterns and cross-sell opportunities.

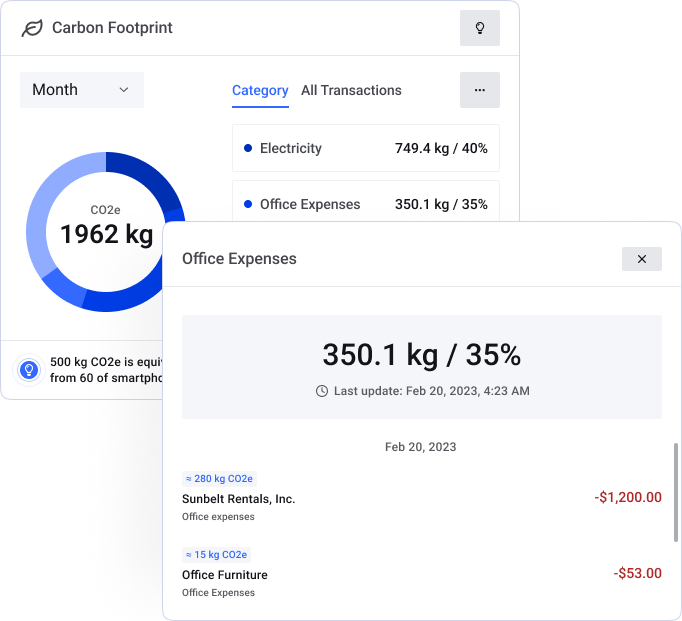

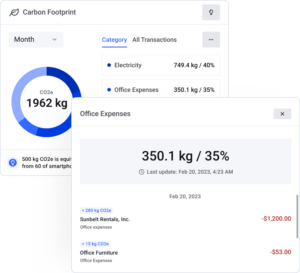

Environment, Social, and Governance (ESG) reflect a business's impact on the environment and society. upSWOT is here to make sense of this as well.

Our ESG component evaluates spending patterns and calculates the business's CO2e. The results allow business owners to make more environmentally conscious spending decisions.

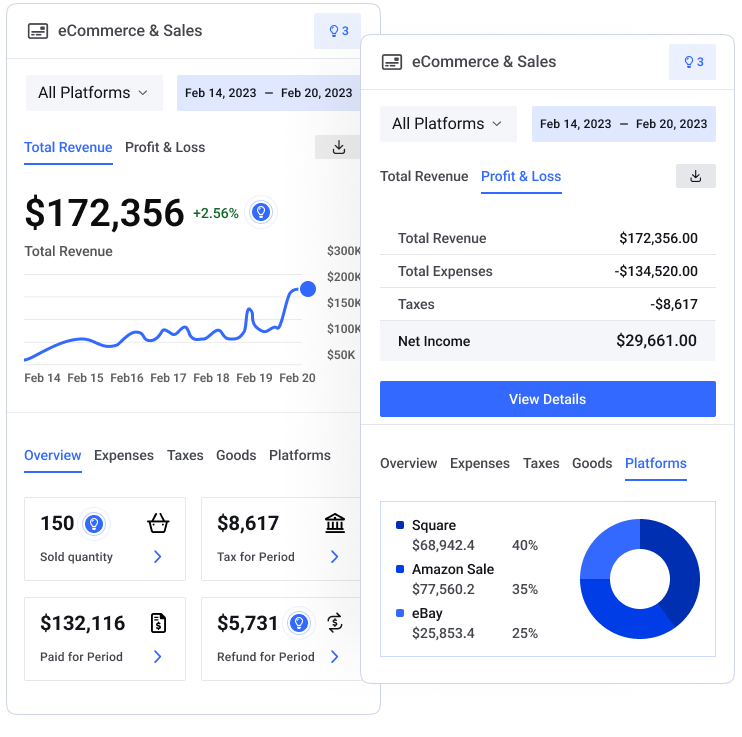

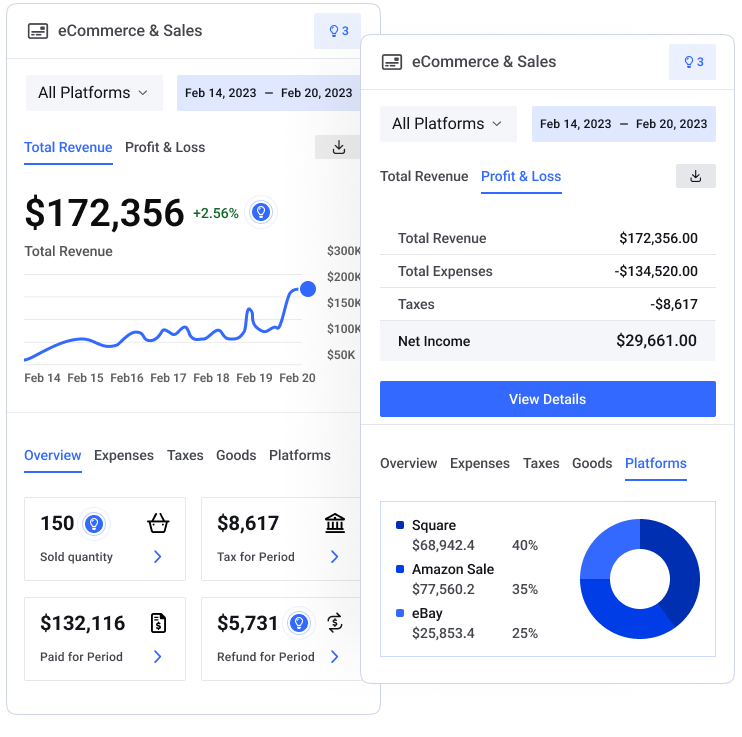

Our eCommerce component provides a clear overview of performance across all connected eCommerce platforms and in aggregate.

Critical to understanding the success of each platform, the tool illustrates trends over time for each channel where there is sales activity. The component shows profitability, margin, efficiency, and other key metrics to improve weaknesses and leverage strengths.

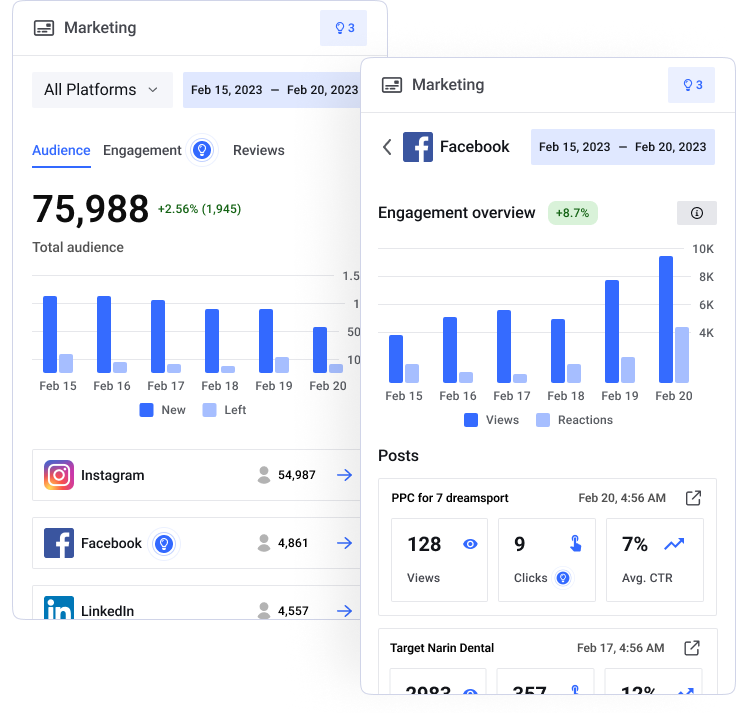

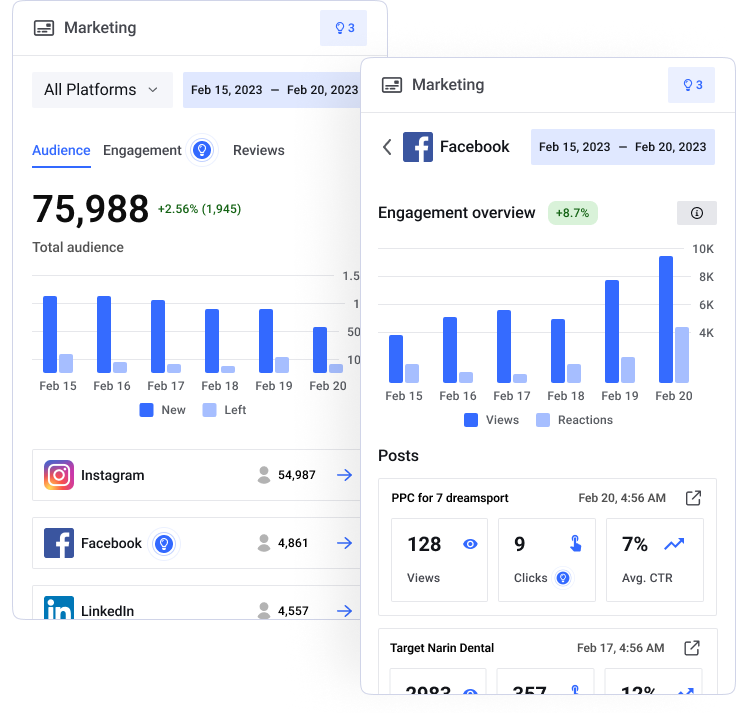

upSWOT can evaluate more than just financial data. Our marketing component looks at each connected platform and presents a clear view of the effectiveness of each solution used.

The aggregated view shows such key metrics as user acquisition strategy, click-thru, engagement, conversion rates, and ROI.

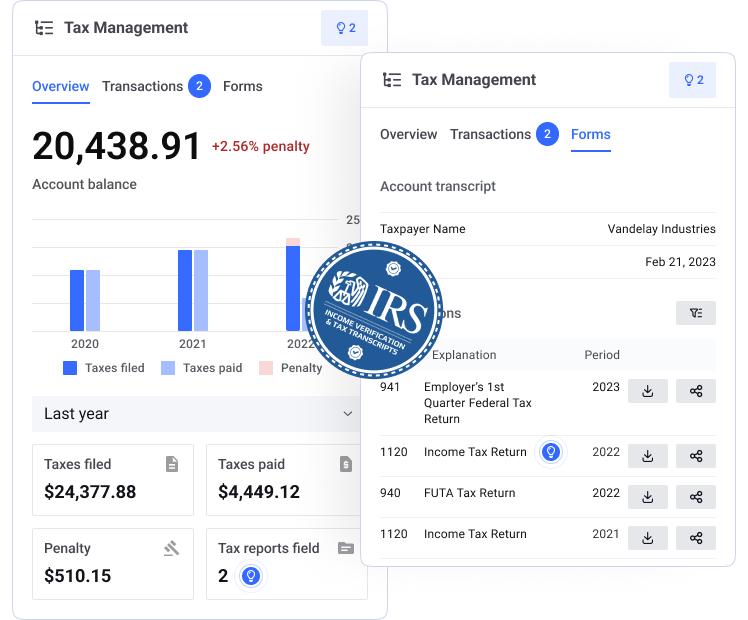

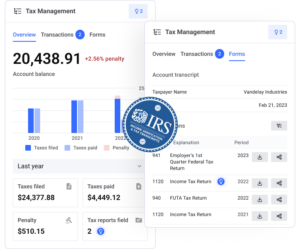

Our tax component allows business to see historical tax filings all in one place at the click of a button.

Users may also download relevant past filing summaries and forms - eliminating the frustration and friction associated with compliance and streamlining the application process for virtually any product or service.

Pull complete tax history with easy-to-read reports

and monitor notices and post-filling cases.

upSWOT’s cash flow forecast presents a graphical projection of cash flow based on analysis from all connected data sources. The tool also allows for scenario modeling to see the impact of changes in revenue, expenses, etc. on cash flow over time.

Revolutionizing how business credit scores are seen, our tool enables businesses toget access to view and boost business credit scores.

Establishing the business credit score results in an improved lending process that expands access to credit, reduces borrowing rates, and better loan conditions.

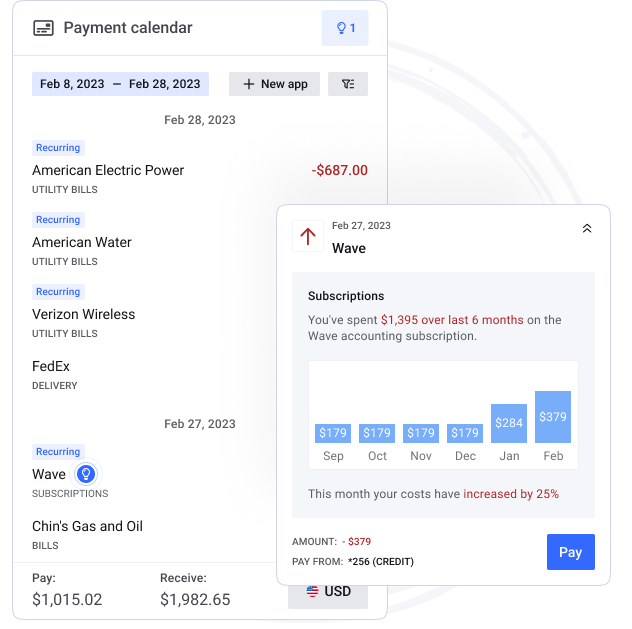

A comprehensive payment guide featuring separate listings of the business’ invoices, bills, and subscriptions.

Actionable alerts include upcoming amounts due, opportunities for savings, and ensure due dates are set on valid business days.

KPIs are calculated based on the business data received from the clients’ connected applications, such as Amazon, Xero, QuickBooks, Square, etc.

The data is constantly updated through our persistent process.

Our insights generator cross-analyzes multiple applications’ data streams to understand current issues facing the business and how to resolve them. The data-driven insights suggest specific actions the business can take to improve operations and profitability.

Insights are delivered in real-time and with context and supporting detail to ensure they are understood and trustworthy.

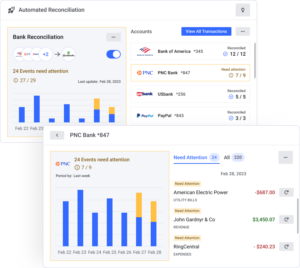

upSWOT can not only pull data from the accounting and ERP applications but we can send to them; automatically reconciling transactions that have settled but have yet to be recorded. This process is continually trained over time and results in time savings, eliminating the frustration of missing expenses.

Business valuation and market value estimates are important tools for setting business strategy. The valuation maps significant insights, tracks shortcomings, solves identifiable issues, and suggests steps to avoid potential problems.

The results from the model selected by our AI can be compared with those of similar public companies, helping businesses look at their performance from a more wholistic, competitive perspective.

Shows businesses their current cash position across all of their accounts including other financial institutions, eWallets, and cryptocurrencies. Where available, open-banking API are leveraged to provide transaction-level detail from aggregated accounts, allowing further insights and analysis of spending patterns and cross-sell opportunities.

As businesses work to reduce their carbon footprint, they can look to this component that provides their CO2e calculations based on analysis of transactions. The results allow business owners to make more environmentally conscious spending decisions.

Our eCommerce component illustrates trends over time for each channel where there is sales activity. The component shows profitability, margin, efficiency, and other key metrics by channel to improve weaknesses and leverage strengths.

Get an aggregated view of your marketing including

key performance indicators such as user acquisition strategy, click-thru and conversion rates, and ROI.

Many business owners manage multiple companies and/or subsidiaries. upSWOT can aggregate those statistics for them and display them in one location.

One of the advantages of our components is maximum customization for your financial institution. Adjust color, font, and just about anything else you can think to ensure our components match your brand perfectly.

Organizes business data across business-critical SaaS applications to deliver real-time insights and personalized recommendations.

Provides businesses with the key to their credit score improvement and within their financial portal to get improved access to capital.

Helps businesses grow and make better decisions by monitoring financial, sales, and marketing data continuously and from one location.

Provides businesses with embedded finance tools, such as cash flow management, business valuations, and forecast builders, to help them grow and scale.

Still on the fence? Reach out and get a detailed view of how you can upSWOT your business.