Major benefits for financial institutions

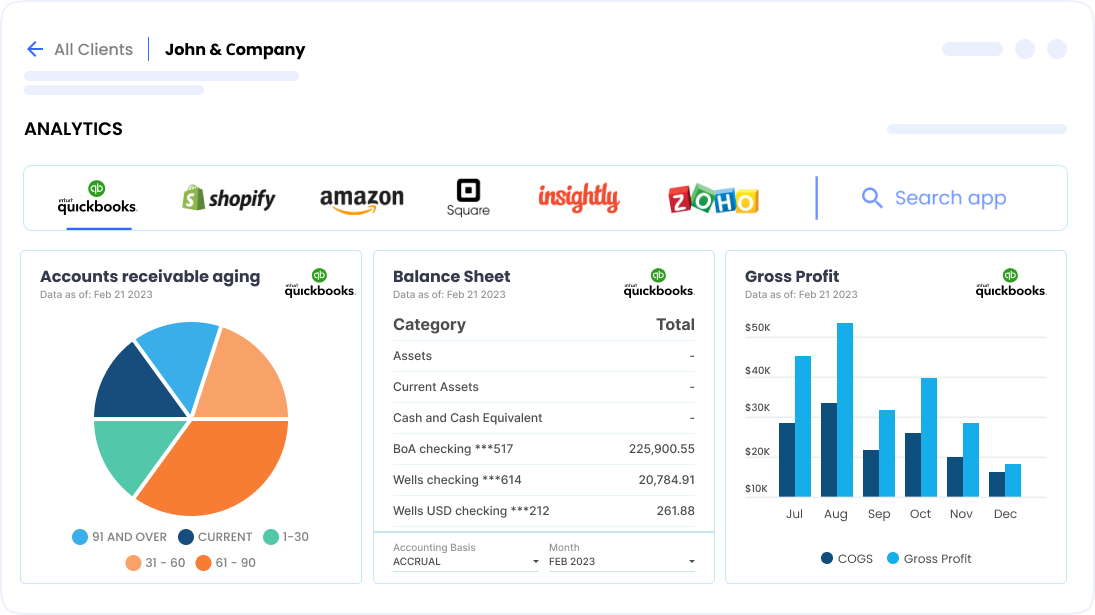

Enhanced digital banking

Increases digital banking engagement and stickiness with business users.

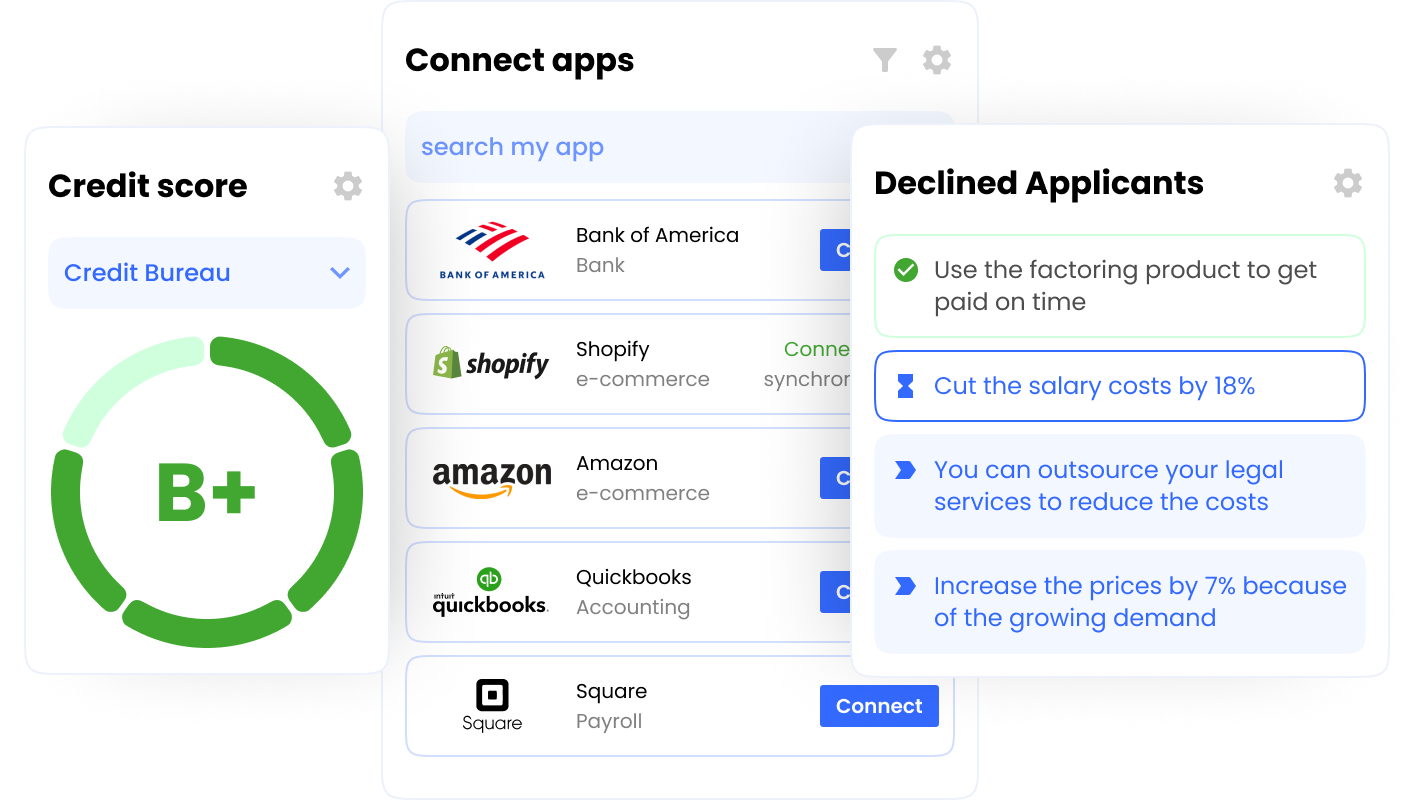

Marketing & sales automation

Provides marketing automation so that relationship managers can offer clients the solution they need before the client knows they need it.

Improved up-sell & cross-sell

Provides financial institutions a deeper understanding of their business customers allowing for customized up-sell and cross-sell opportunities.

Better relationships with business clients

Initiating automated campaigns and notifying relationship managers about new opportunities and risks helps financial institutions become more supportive, proactive, and sales-efficient.